Financial Aid Overview

The Horological Society of New York (HSNY) is dedicated to supporting the next generation of watchmakers through scholarships and awards. These programs are designed to lower financial barriers for students pursuing careers in horology, ensuring that talent can thrive regardless of circumstance.

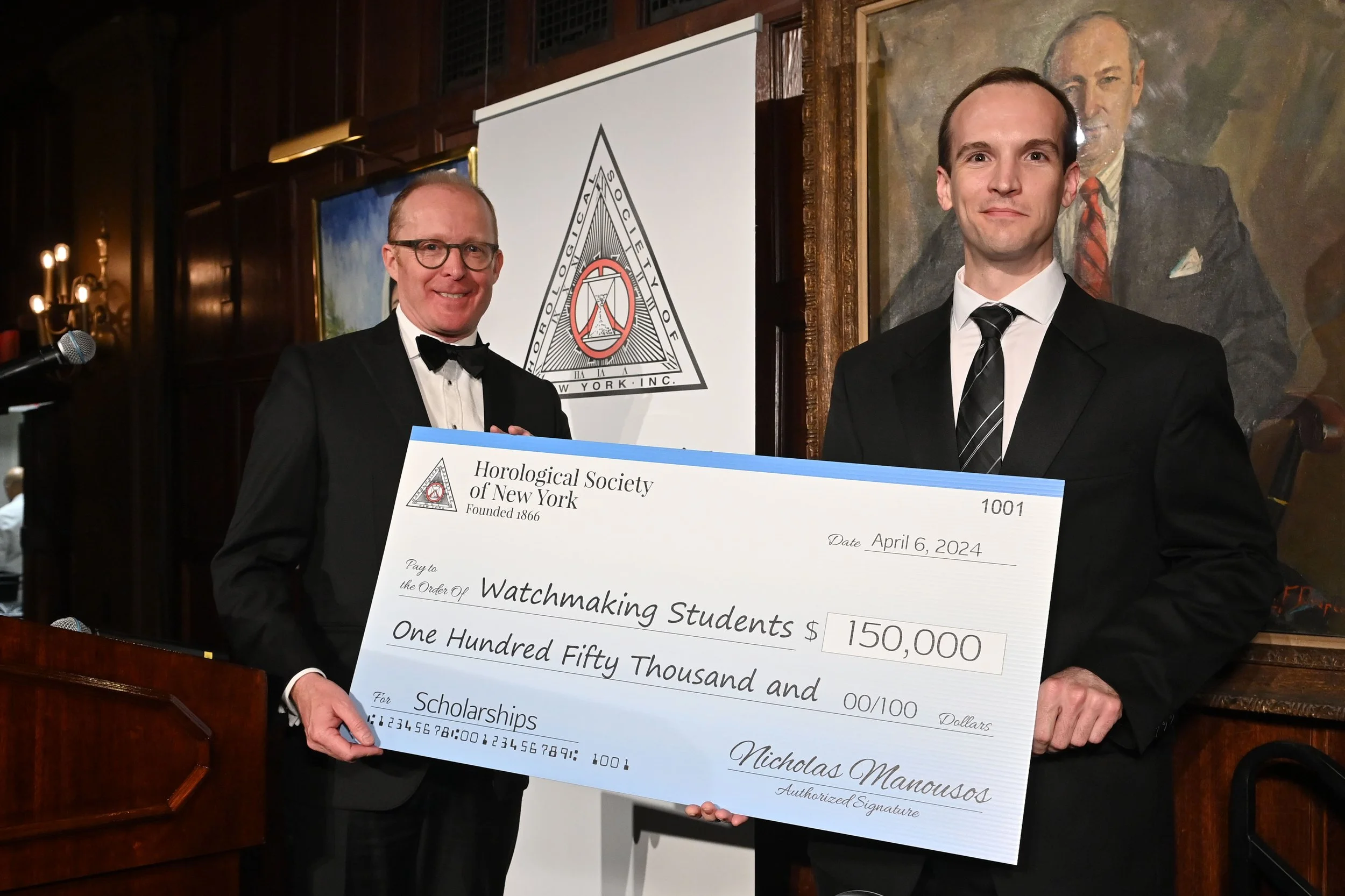

Roger Smith OBE presents a ceremonial giant check to watchmaking student Justin Baxter of the Lititz Watch Technicum, Gala 2024.

Scholarships and awards are made possible through the generosity of HSNY members, donors, and sponsors who share a commitment to advancing horological education. Through these efforts, HSNY ensures that talented individuals are empowered to pursue careers in watchmaking and related disciplines.

Scholarship and award applications are accepted starting in January of each year, and awarded at our annual gala in March.

Scholarships will be disbursed based on the proportion of the recognized educational program the student has completed. Additional funds will be disbursed at the beginning of each quarter/semester/section, in proportion to how much of the program that quarter/semester/section represents.

If a student leaves the program before completion disbursements will be paused. If said student does re-enroll in a watchmaking program within 2 years, their scholarship disbursements will restart. If said student does not re-enroll in a watchmaking program within 2 years the balance of the award is forfeited. If the same student enrolls again in a watchmaking program after 2 years they are not disqualified from applying to HSNY for additional scholarships.

For example, if a student is enrolled in a 2 year program consisting of 8 quarters, and is awarded a scholarship after 4 quarters of enrollment, the initial dispersement would be 50% of their total award. Additional quarterly disbursements would be 12.5% of their total award.

Exempt from the scholarship are board members, trustees, fellows of the Horological Society of New York, and their family members. Grant recipients will be asked to complete a W-9 form before receiving their gift (check) for tax purposes. For more information, contact us.